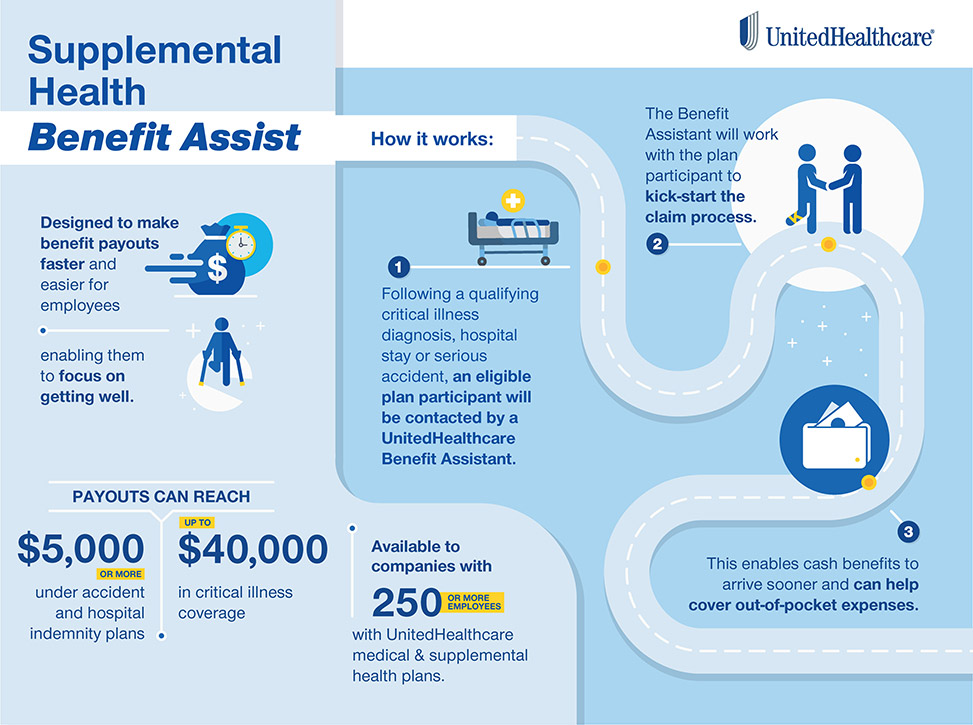

Employees enrolled in UnitedHealthcare accident, critical illness or hospital indemnity protection plans can now receive benefit payouts faster and easier through UnitedHealthcare's industry-first Supplemental Health Benefit Assist Program.

Benefit Assist features a team of UnitedHealthcare Benefit Assistants who contact via phone or email an eligible plan participant following a qualifying critical illness diagnosis, hospital stay or serious accident. The Benefit Assistants help the patient kick-start the claim process soon after the related medical diagnosis or treatment to facilitate a faster payout so that the patient can focus on healing and getting well.

Oftentimes people enrolled in supplemental plans wait weeks or months to start the related claim, or neglect to do so entirely, thus delaying or missing a cash benefit that can help pay out-of-pocket expenses or cover lost income. Payouts under UnitedHealthcare supplemental plan coverage can reach $5,000 or more under accident and hospital indemnity plans; critical illness coverage can reach up to $40,000.

"Almost two-thirds of employees have less than $1,000 on hand to pay out-of-pocket expenses related to an unexpected accident, hospital stay or serious illness. Benefit Assist helps employees receive benefit payouts faster and more efficiently, giving employees peace-of-mind and allowing them to worry less about their finances and focus more on healing and getting healthy," said Tom Wiffler, CEO, UnitedHealthcare Specialty Benefits.

The Supplemental Health Benefit Assist Program is available to companies nationwide with 250 or more employees enrolled in both UnitedHealthcare medical and supplemental health plans, including accident, critical illness or hospital indemnity coverage.

This resource highlights the value to companies and their employees of combining medical and ancillary health benefits, including supplemental health, vision, dental and other financial protection coverage, through a single health plan. More employers are offering supplemental benefit plans as a way to add financial certainty for employees, especially with more than 80 percent of employers now offering consumer-directed health plans. To learn more about the value of integrating medical and specialty benefits, click here.

About UnitedHealthcare

UnitedHealthcare is dedicated to helping people live healthier lives and making the health system work better for everyone by simplifying the health care experience, meeting consumer health and wellness needs, and sustaining trusted relationships with care providers. In the United States, UnitedHealthcare offers the full spectrum of health benefit programs for individuals, employers, and Medicare and Medicaid beneficiaries, and contracts directly with more than 1.2 million physicians and care professionals, and 6,500 hospitals and other care facilities nationwide. The company also provides health benefits and delivers care to people through owned and operated health care facilities in South America. UnitedHealthcare is one of the businesses of UnitedHealth Group (NYSE: UNH), a diversified health care company. For more information, visit UnitedHealthcare at www.uhc.com or follow @UHC on Twitter.

Share This Story